On the eve of CinemaCon, the analysts at Gower Street have some good news: The decidedly subdued forecast for the global cinema business in the current year has been revised upwards, at least a little.

When Gower Street issued its forecast for global cinema sales in 2024 last December, the figures were sobering. Although the months-long strikes by actors and screenwriters meant that some high-profile titles (including, not least, „Dune: Part Two“) had moved from 2023 to 2024 – mainly those that had been completed in principle but which the stars were prevented from promoting due to the strike restrictions – the bottom line was that the current year lost (much) more potential blockbusters than it gained.

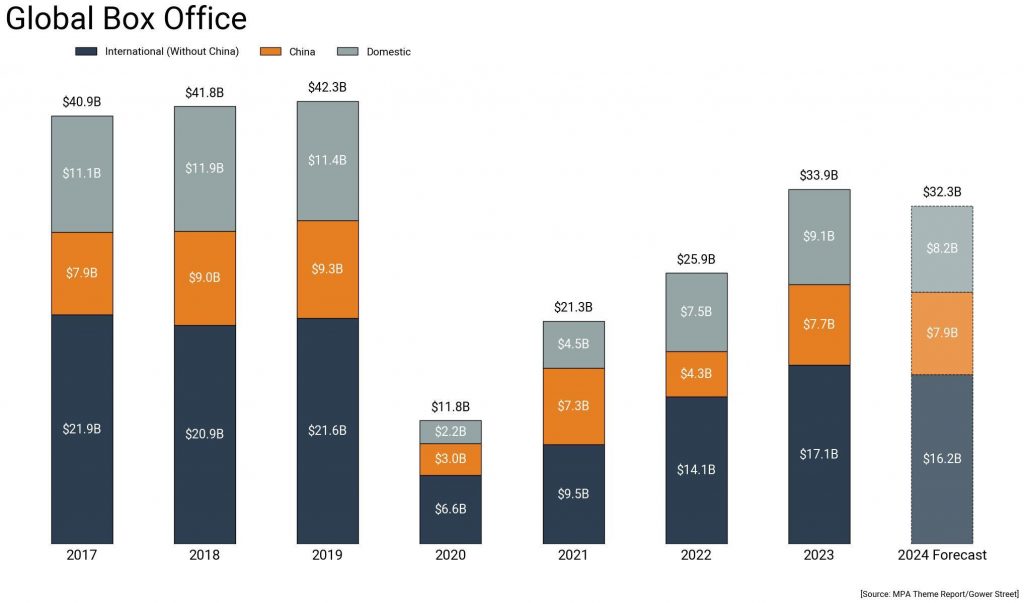

The obvious gaps in the launch calendar prompted Gower Street to issue a very cautious forecast last December. Global ticket sales of 31.5 billion dollars were expected for 2024 – this would have meant a drop of a full seven percent compared to the (estimated) final result for 2023. Even then, however, Gower Street made it clear that this was a very early estimate that had the potential to be revised upwards over the course of the year – especially if the release calendar were to fill up a little better.

According to Gower Street, the latter has already happened to at least a manageable extent in recent months. Furthermore, results between January and March were significantly better than predicted. At least in the markets outside North America. While the original forecast was only exceeded by one percent in the US and Canada (as well as in China), business in the rest of the world was on average eleven percent better than expected.

Accordingly, Gower Street is now forecasting a global box office of 32.3 billion dollars for 2024 – adding around 800 million dollars to the December forecast. The USA and Canada account for an increase of around 200 million dollars; the forecast for China (the only major sub-market that is expected to develop positively overall in 2024) remains largely unchanged and the remaining markets are now expected to generate around 550 million dollars more as was forecast at end of last year. Although this is anything but a big step, it is a step in the right direction.

What’s more: In principle, the development is a bit more positive than it looks at first glance – because according to Gower Street, the increase observed in the first quarter compared to the forecast would have been more than a third higher if the average global exchange rates had not moved so strongly towards the dollar since December. Nevertheless, Gower Street is far from euphoric; at least the first of the usual adjustments to an annual forecast is only „within a manageable range“ according to its own statement.

All in all, a result of 32.3 billion dollars would mean that the global box office would shrink by around five percent compared to the previous year – or by around three percent if today’s exchange rates are used as a benchmark. Compared to the pre-pandemic average for the years 2017 to 2019, sales would fall by 18 percent.

Marc Mensch